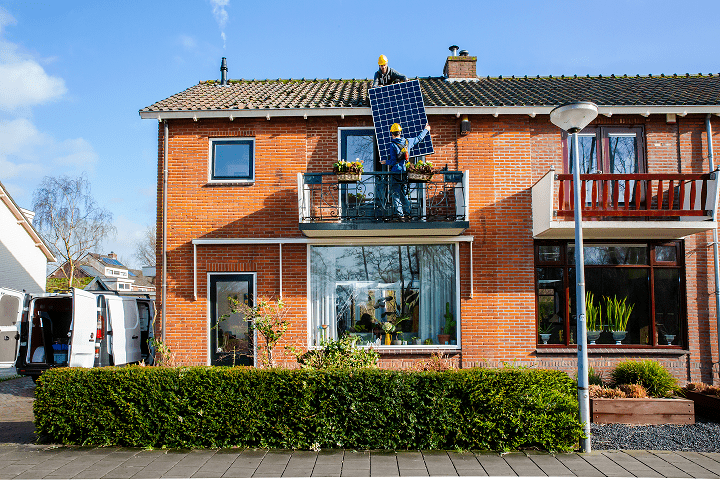

New lending standards make homes with poor energy label more attractive

Consumers expect a dichotomy in the housing market now that the maximum mortgage amount has become partly dependent on the home's energy label. More than half of homeowners and prospective buyers think that homes with good labels will become even more expensive, while poorly insulated homes will decrease in value. This is according to research conducted by Motivaction for a.s.r. among a thousand homeowners and tenants in the free sector.

Since this year, the borrowing capacity for buying a home has depended on the home's energy label. The new standards, intended to stimulate the preservation of the housing stock, lead to mixed reactions among consumers. The survey reveals a fear that houses with poor energy labels (E, F or G) will decrease in value while simultaneously gas and electricity bills are getting higher. 'People with a narrow purse will then be at a disadvantage,' writes one participant in the survey.

The new standards offer (future) homeowners the opportunity to borrow more for sustainability measures the worse their home has an energy label. In doing so, they can reduce their CO2 emissions and energy bills, improve their energy label and see their home increase in value. However, consumers are hugely reluctant to go into debt for sustainability measures. Among those who have taken measures, two out of three have used their own money to do so. Only 6% have used the mortgage and 6% have also borrowed the money elsewhere.

Because of the new lending standards, the willingness to borrow money for preservation did double (12 to 25%). A quarter of people are thus encouraged by the new measures to make their (future) home more sustainable. On the other hand, a quarter think that the new lending standards actually prevent them from buying another home.

Apart from a resistance to borrowing, the biggest doubts are about the return on investment. 46% find that preservation costs too much money. To a lesser extent, people doubt the return (16%) and usefulness (11%). One in ten do not consider themselves handy enough or are wary of the hassle.

Matthijs Hofstede, director of a.s.r. Hypotheken, recognizes the hesitation of homeowners and would-be buyers: "Nevertheless, our own figures show that customers who borrowed extra for energy-saving measures gained an average of one and a half energy labels last year. 87% Of the customers who borrowed money for preservation addressed this amount within one year. They invested an average of 8,686 euros in sustainability measures."

Now that with the new lending standards more money can be borrowed for sustainability, it has actually become more attractive to also look at homes with a less good label. Matthijs Hofstede: "Even first-time buyers really don't have to limit themselves to an A label. I advise people: look broadly at the entire housing stock. You will have more homes to choose from and less competition from other house hunters. And do you have your eye on a house with a lower energy label? Go to an independent financial advisor and have them calculate for you what financing and subsidies are available to make this home more sustainable."

Among respondents who are considering making their homes more sustainable in response to the new lending standards, the heat pump is the favorite (35%), along with insulating glass. Less interest is shown in roof and wall insulation. Compared to other age groups, the 25-34 age group is clearly more open to the various energy-saving measures.

-

10 Dec 2025

Lard Friese steps down from a.s.r.’s Supervisory Board

Lard Friese has decided to step down as a member of the Supervisory Board of ASR Nederland N.V. (a.s.r.) in order to fully focus on his responsibilities at Aegon Ltd. Aegon Ltd will nominate a candidate to succeed him.10 December 2025Utrecht -

9 Dec 2025

a.s.r. receives approval to use its Partial Internal Model for a.s.r. Life

The Dutch Central Bank (DNB) has approved a.s.r.’s application for the use of a Partial Internal Model (PIM) for determining required capital under the Solvency II framework for the ASR Levensverzekering N.V. (a.s.r. Life) entity. This extends the use of the PIM from the Dutch Aegon Life entities to the a.s.r. Life entity and enhances a.s.r.’s overall risk management and capital efficiency.9 December 2025Utrecht -

8 Dec 2025

a.s.r. becomes strategic partner of Groene GGZ

From 2026, a.s.r. will become a strategic partner of the Groene GGZ (Green Mental Healthcare) initiative, which emphasises the importance of nature in mental healthcare. By joining this initiative, a.s.r. underlines the relevance of nature-inclusive care. As a strategic partner, a.s.r. will collaborate with various mental healthcare providers to implement nature-inclusive care into practice.8 December 2025Utrecht